How China’s Short Video Platforms Distribute Their Massive Traffic Across Creators

Short video has exploded in popularity among China’s internet users and become a vital part of any media strategy. However, the unique ecosystem centered around local platforms like Douyin and Kuaishou operates very differently than Western social networks. The mechanism for traffic distribution determines which creators can capitalize on this booming format. This article analyzes China’s short video landscape, platform characteristics, and recommendations for brands looking to leverage short video marketing.

The Rise of Short Video Among China’s Digital Ecosystem

Over 873 million Chinese accessed short video platforms in 2022, representing 91.1% of total internet users. The market is projected to exceed 1.1 billion users by 2027. Fueled by 5G proliferation, smartphone penetration and improving infrastructure in lower-tier cities, demand continues rising exponentially.

Short video has become ingrained among consumer digital habits mainly for entertainment and content discovery. 62.7% of users spend over 60 minutes per day on these apps. Additionally, the format’s simplicity and flexibility have reduced barriers for creators compared to blogs and long-form video. Consequently, supply is abundant with over 30 million Chinese self-media accounts active today.

For brands, short video enables direct reach to mass audiences in a mobile-first paradigm. More importantly, native integration of e-commerce functionality like livestream shopping converts views into sales. Engagement and conversion metrics consistently outperform other social media. These tailwinds have made short video marketing indispensable for China.

Leading Platforms Defining China’s Short Video Landscape

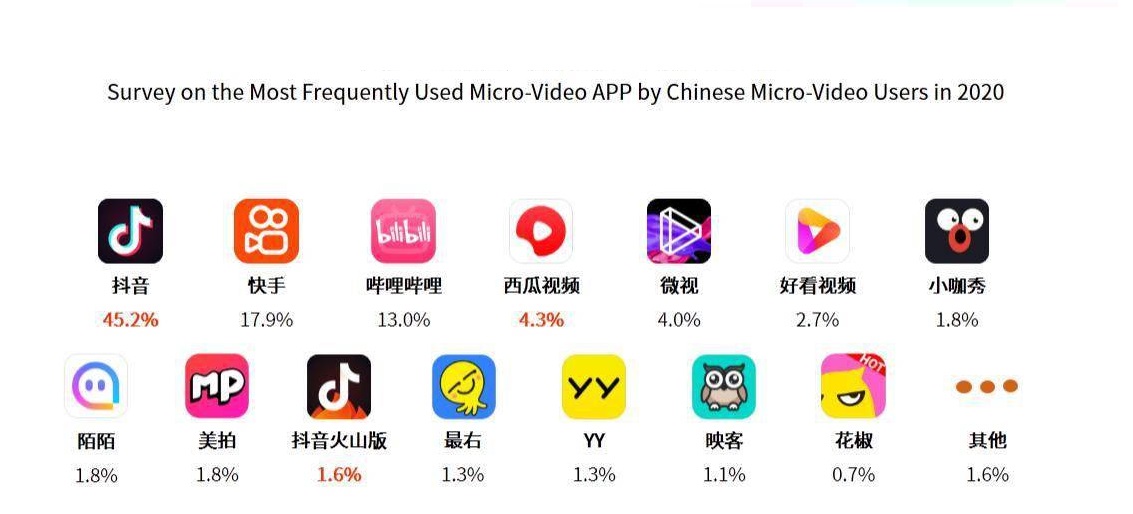

Douyin and Kuaishou command over 60% market share today. Both platforms originated from predecessors TikTok and Kwai but localized extensively for Chinese users.

- Douyin: Launched in 2016, it pioneered the short video format mainstream today. Very strong among youth in Tier 1-3 cities from 18-35 years old. Known for entertainment, trends and memes. Over 600 million monthly active users (MAUs).

- Kuaishou: Founded in 2011, it initially focused livestreaming before pivoting to short video. Strong in lower-tier cities. Popular among older working class from 25-50 year olds seeking informational content. Over 250 million MAUs.

Complementing these giants, Bilibili targets Generation Z and subcultures with its anime/gaming focus. Haokan, Xigua and Quanmin K Gei are other top players with respective strengths around news, living streams and games.

The Mechanics Behind Traffic Distribution on Short Video Platforms

There are two key factors determining the visibility and distribution of short video content:

- Algorithms rewarding engagement and relevance

- Incentive systems encouraging creation that aligns with platform objectives

a) Platforms first check for duplicate content by comparing videos with similar ones. A combination of human reviewers and AI then screens for sensitive keywords.

b) Videos are benchmarked against competing ones in the same interest vertical during the same time period. Based on completion rate, shares, comments, likes and search demand, the top performers reach wider traffic pools.

- Stepped traffic pools: 0-500 (initial) -> 1,200-1,300 -> higher volumes

More granular engagement metrics: e.g. total likes, number of first-time likers. For completion rate – duration and percentage watched. - Search volume signals consumer mindshare and demand.

- Interest verticals defined from the user perspective rather than industry. E.g. “new moms” span multiple sectors like parenting, beauty, apparel, furniture. For that target group, those sectors compete in the same vertical.

In essence, the platforms leverage data to accurately match content with audiences for maximum engagement. Creators responding to user Feedback loops and platform incentives get the most traffic. This virtuous cycle is how short video apps capture user time and attention so effectively in China.

Conclusion

Short video has become the dominant online entertainment medium with its simple, snackable format resonating with Chinese consumers. However, flourishing in this ecosystem requires embracing the unique culture shaped by leading platforms like Douyin and Kuaishou. Where attention goes, money flows shortly after.

For brands exploring short video campaigns, putting users first is essential. Then examining channel analytics guides optimal content that balances creativity, trends and incentives. Maintaining patience and persistence also pays long-term dividends. It takes time for algorithms to gather data before exponential reach and virality kicks in.

Following these best practices will equip brands to earn their share of China’s booming short video audience. Getting the distribution formula right can drive brand building and direct sales to new heights.